The purpose of accumulating retirement savings with tax-advantaged retirement accounts is to withdraw an income that will last for the duration of your retired lifetime. Considering this could be thirty or forty years, it’s important to get this right. Efficient retirement account withdrawals can help stretch your savings and achieve this goal.

Clearly then, you should consider efficient retirement account withdrawal strategies that maximize the after-tax value of retirement income. In order to maximize the value of withdrawals from a retirement account, you have a number of options.

Build a Larger Nest Egg

One option you have is to maximize the dollar amount of your retirement portfolio. In the case of your savings, this could mean one of two things.

If you aren’t already retired the first is that you save a large amount. Since increasing your savings rate means a reduction in current lifestyle, there will be practical limitations to this. It’s hard to think about adding another dollar to a retirement account when there are so many current consumption needs.

Take on More Investment Risk

You could also earn a high return on the amount that you do save. Once again, there is a trade-off here that will result in a practical limitation. Earning a high rate of return on investments will necessitate taking on a high level of risk. Risk itself is not bad. Some level of risk is good. Too much risk, however, is not.

The hopeful result would be that you would have more money in the account to withdraw from.

Delay Retirement

A second option is to delay retirement. Delaying retirement has two effects. One is that you are reducing the number of withdrawals you take. One less year in retirement is one less year of taking withdrawals. The other effect, closely related to the first, is that it’s one more year of CONTRIBUTIONS. This means there is a potential exponential effect of delaying retirement.

Again, the result is more money in the account.

Take Efficient Withdrawals

The option I’ll address in this article is how to efficiently withdraw from your retirement accounts. Regardless of the amount of retirement savings you have, efficiently withdrawing that money will increase its total value.

Like most things financial, there are some basic rules of thumb that many use as a starting point when deciding how to withdraw their retirement funds most effectively. Usually, these strategies speak to the order in which to withdraw from retirement accounts. For purposes of ordering the retirement accounts for a withdrawal strategy, accounts are categorized into three different groups:

Brokerage accounts – Brokerage accounts do not provide for tax advantages. Earnings from investments are taxed when realized (for the most part). Capital gains (both short and long-term capital gains), interest income, dividends (qualified and non-qualified) are all taxed along the way. This is often the least tax-efficient account in which investments can be held.

Traditional (tax-deferred) – Traditional accounts (IRA, 401k, 403b, SEP, SIMPLE,…) allow investors to accumulate retirement savings in a tax-advantaged manner. The advantage here is that the investor gets to write off contributions in the year they are made. Taxes are put off until the money is withdrawn in retirement at which point it is taxed at the investors marginal income tax rate.

Roth (after-tax) – Roth accounts allow investors to accumulate retirement savings in a tax-advantaged manner as well. For a Roth retirement account, the investment contributions do not create a current tax year reduction of income. Instead, the investor is able to withdraw the money (which includes the earnings within the account) without incurring a tax liability.

Mix of Accounts

It is not uncommon for your retirement savings to be spread out over several different accounts. In this situation the standard practice is to withdraw from brokerage accounts first since they provide the least tax advantage. Next, you would withdraw from one of your tax-advantaged accounts.

However, by blending the withdrawals across different accounts you can extend the time that your savings lasts.

The reason for this is the taxation of withdrawals. When you withdraw completely from one type of account at a time, you distort the balance of taxation. Given the progressive nature of income taxes, this is very inefficient. This inefficiency means you will keep less of each dollar that you withdraw.

In fact, given contributions limits for retirement accounts it sometimes makes sense to open a taxable account to hold the more tax-efficient investments. Since some investments can take advantage of the favorable long-term capital gains tax rates you could actually save money by holding them in a taxable account.

Taking all withdrawals from one account

I’ll use an unrealistically simple example to illustrate the point.

Suppose you have two accounts, a Roth IRA and a Traditional IRA. Each account has $100,000 for a total of $200,000. Next, suppose that you want to withdraw $100,000 each year. Assuming no investment returns, this will last two years.

If you decide first to withdraw from the Roth IRA you will not owe any taxes in the first year. Of course, this leaves you withdrawing the full amount from your Traditional IRA in the second year. This withdrawal is entirely taxable.

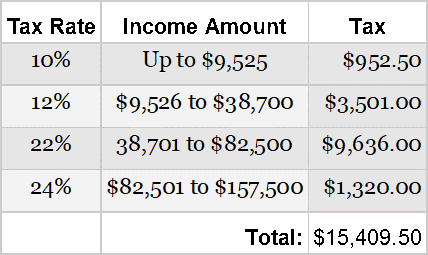

Assuming you are single and take the standard deduction, your taxes for the second year would look as follows:

$100,000 taxable withdrawal – $12,000 standard deduction = $88,000 taxable income

Since you withdrew $100,000 from your account you are left with $84,590.50.

Taking withdrawals from each account to maximize tax-efficiency

Now consider the same example, but in this situation you take half of the withdrawal from each account. You still have a total of $100,000 that you are withdrawing each year, but the after-tax value of those withdrawals is higher.

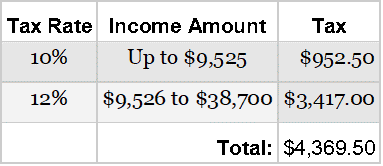

For each year, you withdraw $50,000 from your Roth IRA. This amount is not taxable. You also withdraw $50,000 each year from your Traditional IRA. This amount is taxable. Your taxes for each year are as follows:

$50,000 taxable withdrawal – $12,000 standard deduction = $38,000 taxable income

For two years, your total tax bill would be $8,739. This is a 43.29% tax savings over taking all of the distributions from one account at a time.

Your after-tax amount each year is $91,261. Compare this to the $84,590.50. By taking half of the withdrawal from each account, you increase your after-tax income by 7.89%.

What about Social Security?

Even for an overly simplistic example we need to consider the role that Social Security plays. The reason for this is that Social Security is progressively taxable. This is distinct from the idea of a progressive tax rate structure whereby larger tax rates apply to larger taxable income. Progressively taxable means that with greater income, a greater portion of your Social Security becomes taxable in the first place.

If you aren’t yet taking Social Security, then the following does not apply.

Taxation of Social Security

Your provisional income is half of your Social Security benefit, plus all other income. Do not add distributions from Roth accounts. However, do include distributions from traditional tax-deferred accounts.

All withdrawals from one account

Assume you collect $20,000 in Social Security benefits each year. Half of that is $10,000.

Since that is all of your provisional income in the first year you would not owe any tax on your Social Security benefits.

Add that to your other income of 100,000 in the second year and you get $110,000 of provisional income. At this level of income for a single person 85% of your Social Security benefit is taxable. $17,000 is 85% of $20,000. Add this to your taxable income of $88,000.

Notice that the entirety of the $17,000 of Social Security falls within the 24% tax bracket. That means that you will lose $4,080 to taxes in the second year.

Proportional withdrawals

Your provisional income for the second scenario is $50,000 withdrawn from the traditional account + $10,000 of Social Security for $60,000. For a single taxpayer at this level of income, Social Security is once again 85% taxable for $17,000.

Add the taxable portion of Social Security ($17,000) to your taxable income each year ($38,000) for a total of $54,000 of taxable income each year.

Notice this time that the entirety of the taxable portion of Social Security spans two tax rates. The first $700 of taxable Social Security is taxed at the 12% rate. The remaining $16,300 is taxed at the 22% rate. Both of these rates are less than the 24% rate of the first scenario.

Total taxation on Social Security benefits in this scenario would be $3,670. Since this would happen for both years, the total taxation is $7,340. This is more than you would pay if you took all withdrawals from one account.

Take all withdrawals from one account or proportionally?

In this case it is still better to take the withdrawals proportionally.

For the scenario where you take all withdrawals from one account at a time, you pay a total of $19,480.50 in taxes.

In the scenario where you take withdrawals proportionally, you pay a total of $16,079.