We help you build and follow a plan for retirement.

Whether you want a plan to manage on your own or a full-service solution

There’s just one way we’ll start.

1

First, we'll gauge what you'll need.

Tell us about your desired lifestyle and preferences so we know what an ideal retirement looks like for you.

Then, we'll review where you are.

We’ll consider retirement income needs, health care options, investments, savings, Social Security, and tax reduction.

2

3

Next, we'll assess your financial personality.

With some clarifying questions, we’ll get to know what a healthy balance between security and satisfaction in life looks like for you. This guides us on the best ways to manage risks you might face.

Then, build a plan.

4

5

So, you can take a sigh of relief.

Get a custom one-time plan to manage and execute on your own or hire our team for ongoing support.

Hire our team to manage your retirement plan for you.

Beyond our team monitoring the health of your portfolio, you’ll also get:

- Your initial retirement plan, including a withdrawal strategy that provides you with an income stream calculated to last as long as you need it to.

- Virtual/In-person financial planning consultations, at least once a year to discuss any changes, questions, or just catch up. Beyond that, we can talk as often as you’d like. We’ll help you navigate any changes that arise in your life, such as acquiring a part-time job, making a big purchase, receiving an inheritance, changing life insurance, and beyond.

- Regular tax analysis to help you withdraw strategically and save money on your taxes.

- Investment management, which includes helping you reduce investment expenses and construct a portfolio to achieve the ideal level of risk and return.

- Health care & Social Security planning to ensure your retirement plan maximizes the benefits that you have contributed to over your entire working life.

- Estate Planning Assistance, we’ll support you in ensuring your transition of wealth to future generations or charities is executed to align with your legacy goals.

As fee-only fiduciaries, we are independent of any product recommendations and legally obligated to always work in our client’s best interest.

Your advisory fee is a simple annual percentage of the account value as follows:

Account Value / Annual Fee

$0 to $100,000 / 1.25%

$100,001 to $1,000,000 / 1.00%

$1,000,0001 to $5,000,000 / 0.9%

$5,000,001 and above / 0.8%

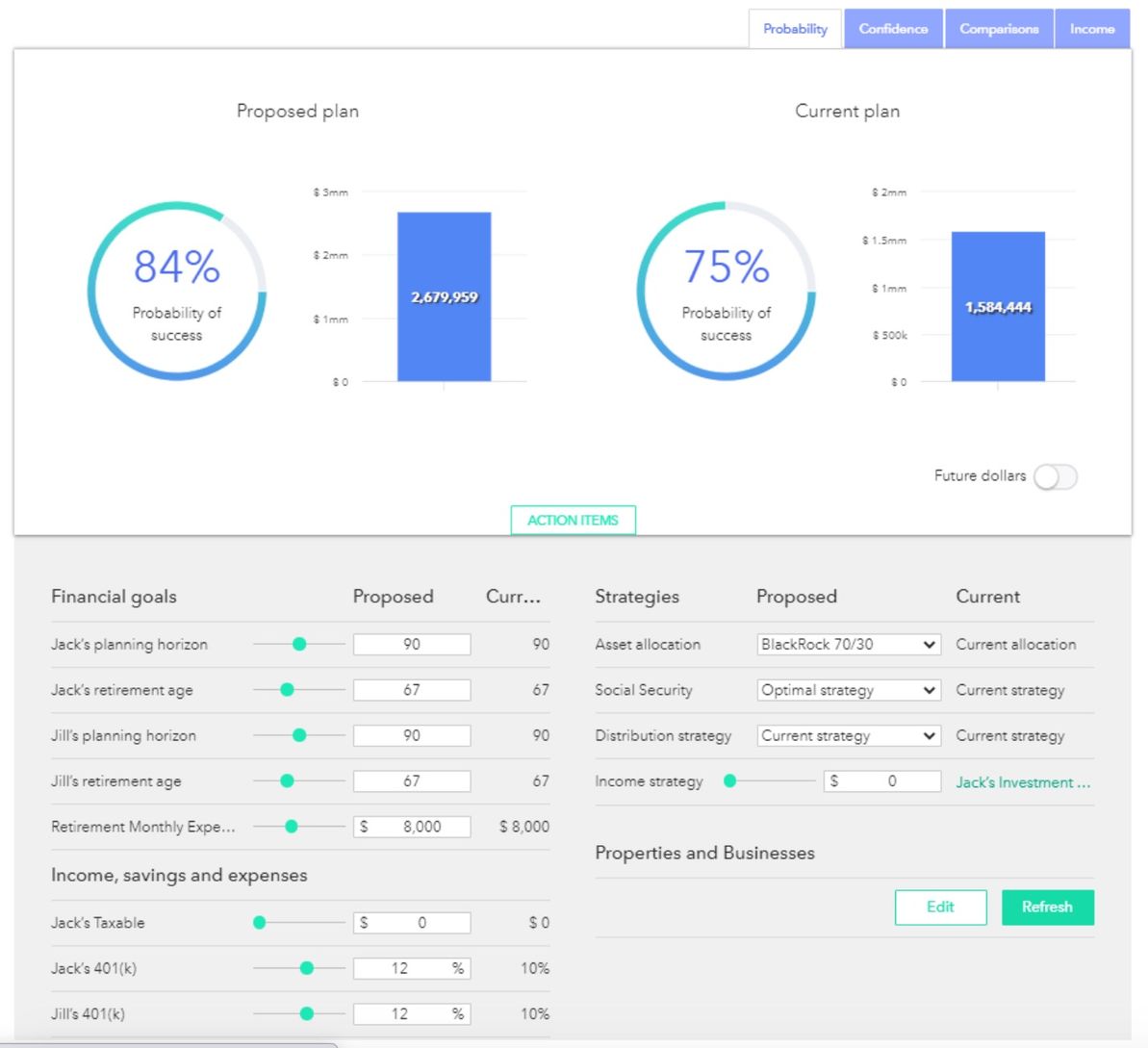

Track your progress in real time.

- Log in whenever you want to see where your account stands in real time.

- Glance at the probability of success percentages to see how you are actively progressing towards your goals.

- Play with amounts and scenarios to view hypothetical outcomes, without the risk of messing anything up!