One withdrawal strategy that you could use for your retirement income is to withdraw a fixed percentage of your portfolio each year. Because of its simplicity this approach may be appealing to you. It is also very easy to implement.

In this article I’m going to explain how this strategy works, and its pros and cons. I’ll also discuss some situations where you may want to avoid using this strategy, and some situations for which it may be more suitable. As with any withdrawal strategy, it’s a matter of understanding the pros and cons and applying them to your own set of conditions.

Withdrawing a Fixed Percentage

This strategy is very simple. You choose a percentage to withdraw, and stick with it each year. There aren’t any further adjustments or considerations beyond that. Other withdrawal strategies such as the 4% rule or the Guyton-Klinger Guardrail strategy involve making adjustments based on inflation or to stay within certain bounds.

As an example, you may decide to use a 4% withdrawal rate. You simply withdraw 4% of the balance of your account each year. As a practical matter you may want to divide this up each month. In that case, you would withdraw .33% each month. Again, the point is that the percentage is fixed and does not change.

Dollar Amount of Withdrawals

Percentages are fun, but you spend dollars. So, what dollar amount will you withdraw each year? Lets start with a $500,000 portfolio as an example. If you withdraw 4% of that, you would have $20,000 to spend. Again, very straightforward.

Here is where this strategy starts to depart from from the others. Generally, you only apply the withdrawal percentage to the initial balance in the first year. Beyond that, you make adjustments to the dollar amount that you withdraw. In other words, you would base your second year withdrawal on the $20,000.

For the fixed percentage strategy though, you start fresh every year. So, you withdraw 4% of whatever the portfolio balance is that year.

This presents a few problems, as well as a few benefits.

Inconsistent Withdrawal Amounts

The most significant problem this withdrawal strategy will give you is the inconsistency of the withdrawal amount. To illustrate this I’m going to show you some real-world data in an example.

A common portfolio for a retiree might consist of 60% stocks and 40% bonds. I’m not suggesting this is the ideal portfolio, only that its common so its what I’ll use to show you this strategy. We will estimate the return data using the Ibbotson Yearbook (common practice in financial research).

For the 60% stocks I’ll use the Large Cap, and for the bonds I’ll use intermediate term government bonds. Again, portfolios will vary, but this is a common “vanilla” retirement portfolio.

So, how does the portfolio, and your retirement withdrawals, fare?

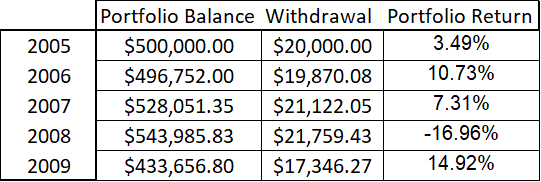

I’ll look at a five-year period so that you’ll see enough to learn the concept without getting swamped with an endless stream of numbers. I went back to 2005-2009 so that you can see the 2008 crash incorporated into the plan.

As you can see from the chart below, the withdrawal amount each year varies with the returns in the portfolio. The Portfolio Balance shows the balance at the beginning of the year. The Withdrawal amount is simply 4% of the balance at the beginning of the year. Lastly, the Portfolio Return gives the return of the 60/40 that year.

For each subsequent year, I subtract the withdrawal and grow (or shrink) the portfolio accordingly.

These inconsistent withdrawals may or may not seem like a big deal to you. However, keep in mind these withdrawals are nominal dollar amounts. You haven’t adjusted them for inflation.

Adjusting for Inflation

Remember that other withdrawal strategies typically account for an inflation adjustment. If you withdraw a fixed percentage, there is no direct adjustment for inflation. Realize too, that you will rely on these income distributions to buy food, clothes, gas for travel, medicine, vacations, and gifts for grand kids. As you know, the prices of these things DO increase with inflation.

We need to compare the nominal dollars in the chart then to what they would buy considering inflation. In economics, we call this purchasing power. Imagine yourself retiring. Now imagine the income you will have 10 years after you retire. Whats more important to you, the AMOUNT of that income, or what it buy?

Obviously, what it will buy.

The following section explains the calculation to adjust for inflation… if you don’t feel like earning college credits today you can skip the next chart and two paragraphs.

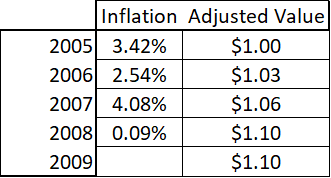

In the chart below, you can see the adjusted value of a dollar for each year. The Adjusted Value column answers the question “How much do I need in today’s dollars to be able to buy what $1.00 would have bought in 2005?”

Each years adjusted value represents the previous years value, adjusted for the previous years inflation. In other words, $1.00 in 2005 will buy $1.00 worth of stuff in 2005. However, since inflation is 3.42% it will take an additional $.03 to buy the same amount in 2006. The process is repeated each year. Since it takes $1.03 in 2006 to buy what $1.00 would buy in 2005, and inflation is 2.54% in 2006, it would take an additional 2.54% of $1.03 in 2007.

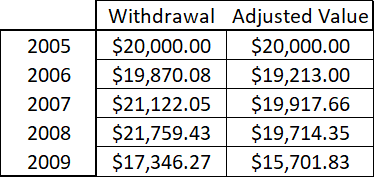

Now, we can use those values to convert the withdrawal amount into a value that represents purchasing power.

The Withdrawal shows the withdrawal amount based on the fixed 4% withdrawal. The Adjusted Value shows the inflation-adjusted value of that withdrawal. Clearly, in this real-world example, the value of the withdrawal declines.

Budgeting in Retirement

You should not conclude from the previous analysis that the real value of the withdrawal will always decline with this strategy. The key takeaway here is that there isn’t much of a plan for the value of the withdrawals. (In fact, theoretically, your withdrawals SHOULD keep up with inflation over the long term since stocks tend to provide positive inflation adjusted returns over the long term.)

Personal budgeting though, isn’t really a long-term averages type of thing. You need to withdraw an actual amount of money each year to buy the things you need and want. In most cases, it will be better to have a more structured plan for determining the amount of the withdrawals so that you can simply live your life.

Will I Ever Run Out of Money?

No. I’m sure your next question is, “But what if I withdraw a large percentage like 25%?” The answer is still no. The biggest benefit of this strategy is it cannot deplete your portfolio.

However, there is still a very practical concern with the withdrawal rate.

If you withdraw a constant percentage that is too high, like 25%, it is a mathematical truism that you will never run out of money. However, the amount that you withdraw can become so small as to be practically worthless.

If you target a reasonable withdrawal rate, then you can maintain a significant balance in your account. That is another benefit of this strategy. If you want to leave an inheritance, using this strategy with a reasonable withdrawal rate will allow you to do that.

Is This A Good Strategy For Me?

This depends on how much you need consistency in your withdrawal amounts. That will depend on what other sources of retirement income you have. For our first example here, lets go with the simplest. Assume you have no other source of retirement income, including Social Security. In that case, you would have some basic expenses that you would want to be able to cover no matter what. This strategy is not likely to be a good one for you. There is too much uncertainty in your income.

What if I have other sources of income?

The more sources of retirement income you have, the better this strategy could work for you. This is particularly true if those other sources of income are more stable. Social Security is a good example. Social Security provides a consistent payment. With Social Security you know how much you will get each month. That consistency gives you a solid foundation on which you can base your budget.

If those other sources of income provide a more significant portion of your total retirement income, that is also a sign that this strategy could work for you.

Suppose you have a good Social Security benefit coupled with a pension from an employer or the military. Both of these fixed payments provide an even higher level of stable income.

Say you need $6,000 per month to live comfortably in retirement. Now suppose you have Social Security + other pension payments that total $5,000. Since your fixed payments cover so much of it, you can tolerate a little more variability from your investment account.

What if I don’t like the uncertainty of this plan or don’t have income from other sources?

Those are both good reasons to use a different strategy. A typical situation would be someone that has Social Security payments, which are stable, but that don’t cover much of your retirement expenses. For instance, say you need $8,000 per month in retirement but Social Security only provides $3,000. You may not want to use a fixed percentage withdrawal rate strategy. It wouldn’t be consistent enough to rely on it to make up such a significant portion of your income needs.