Questions to Ask a Financial Advisor About Retirement

What are some questions to ask a financial advisor about retirement to make sure you are thinking about all the important issues and that your

What are some questions to ask a financial advisor about retirement to make sure you are thinking about all the important issues and that your

This simple retirement calculator will help you quickly see if you are ready to retire. You can also use this retirement calculator to see how

This 403b calculator can help you whether you need to know how much you should be contributing to your 403b or if you are nearing

If you are wondering whether you can reinvest your required minimum distribution, then chances are you have one coming up that you realize you don’t

Taxes are an unavoidable truth of retirement planning and investing. However, avoiding capital gains tax on stocks is a good way to lower your total

Your vested balance is the amount of money in your retirement account that belongs to you. If you quit your job or leave your employer, your

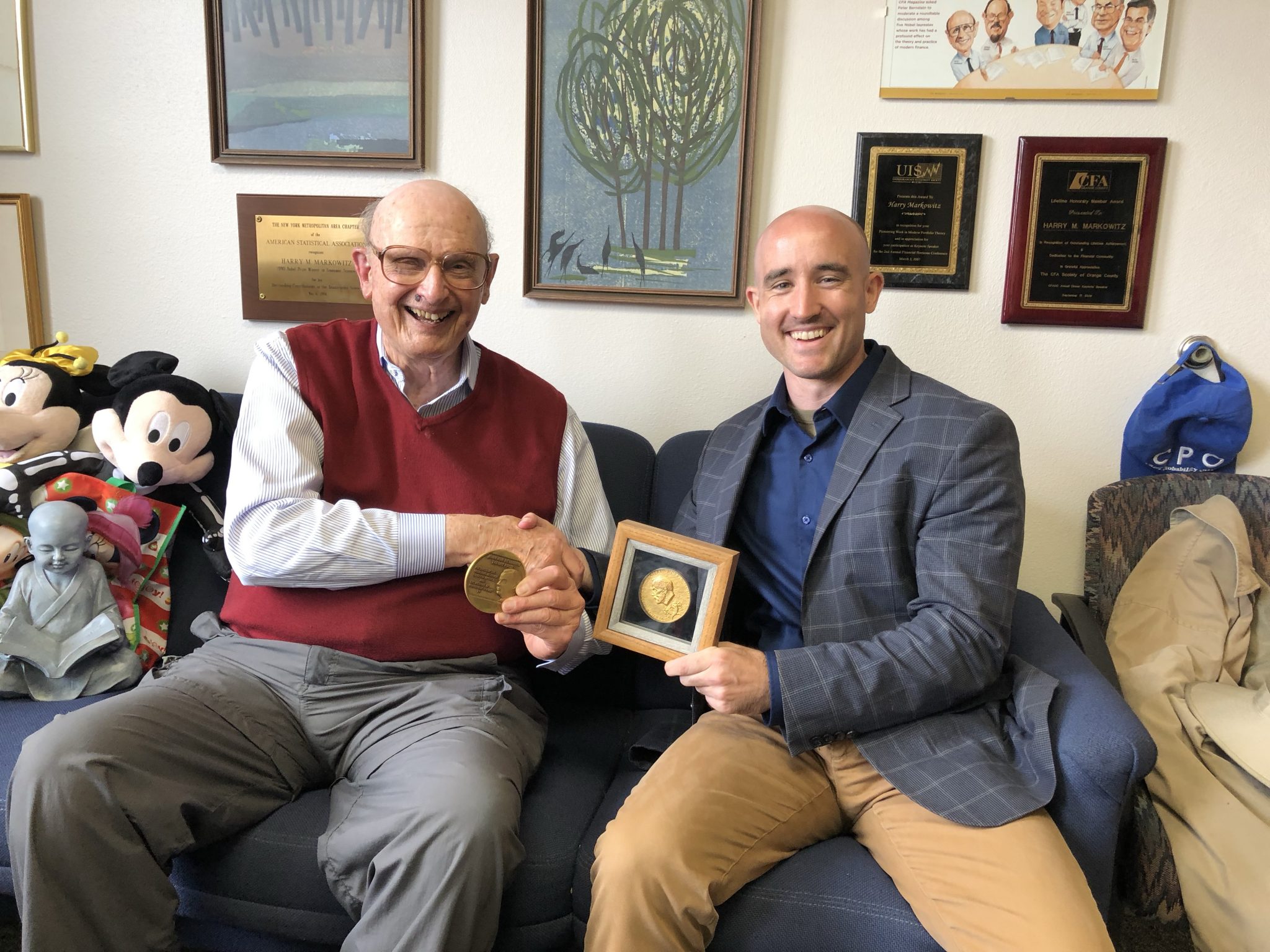

Fair warning, this post is a departure from my normal articles on retirement planning. I had an opportunity to meet one of the founding fathers

The simple fact that you are retired doesn’t mean you can’t contribute to an IRA. You can still contribute to an IRA if you are

It is possible to retire on 500k in retirement savings, but you’ll need to do some careful planning. There aren’t many universal answers to retirement

If you contributed too much to your 401k you may end up owing a penalty. Depending on when you realize that you have contributed too

There are two different annual limits on 401k contributions. The elective deferrals limit, and the annual additions limit. Your employer match counts toward one, but

Want to know how long your money will last with systematic withdrawals? Use the retirement withdrawal calculator to give you a good reference point. It’s

In-kind distributions can sometimes provide tax or other benefits that a cash distribution doesn’t. So what is an in-kind distribution? Any distribution NOT made in

As for dramatic names, the Goodman Triangle wins the competition with the moniker “Unholy Trinity of Life Insurance”. Maybe I watched too many horror movies

If you have $600,000 saved toward retirement can you retire? It may be possible. It really all depends on what is important to you in

Market dips are inevitable. If you have been saving for retirement for decades, then you are no doubt aware of market fluctuations and have weathered

In this article I’m going to explain what index investing is and why it is such a good strategy for your retirement. This article goes

What are the risks of relying on dividends for retirement income? Like most things used in moderation there isn’t anything wrong with dividends, or the

That’s not a typo. While asset allocation is a common investment term, asset location is an often overlooked aspect of retirement planning. That is unfortunate

The purpose of accumulating retirement savings with tax-advantaged retirement accounts is to withdraw an income that will last for the duration of your retired lifetime.

Brandon Renfro LLC (“Belonging Wealth Management”) is a registered investment adviser offering fee only advisory services in the State of Texas and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state by Brandon Renfro in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption.All written content on this site is for information purposes only. Opinions expressed herein are solely those of Belonging Wealth Management, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation.