Having trouble understanding what a primary or contingent beneficiary is? Deciding between per stirpes vs. per capita? I’ll address it all in this article.

When you name beneficiaries on a retirement account application there is an implied assumption that you will pass away before they do. Most people name their spouse as a beneficiary for what are hopefully obvious reasons.

Of course, it doesn’t always work out that you pass away first. Primary beneficiaries, the first people in line to inherit an account, sometimes pass away due to accidents or illness. If that happens, how will your accounts be distributed when you pass?

If you have named any, your account will go to contingent beneficiaries. A contingent beneficiary is the person next in line to receive the account if the primary beneficiary has already passed. There is a space on account opening documents to name both primary and contingent beneficiaries.

Children, for example, are common to name as contingent beneficiaries. It’s very natural to assume you will pass away before your children. By naming them as contingent beneficiaries, you hope to leave your money or property to them if you and your spouse both pass.

Contingent Beneficiaries: Per Stirpes vs Per Capita?

If one of your named beneficiaries predeceases you, your money will transfer to remaining primary or contingent beneficiaries. However, you need to be aware of exactly how your money is distributed in the event that one or more of your beneficiaries is already deceased. It’s important to know because you have to decide!

You can choose to have your account distributed either per stirpes or per capita.

You make the per stirpes vs per capita election beforehand, at the time you open the account. (Remember, you’ll be dead when it’s triggered!)

Since this is an election you make on all retirement accounts like IRAs, 401ks, and 403bs, it’s important to understand.

If it’s been a while and you can’t remember what you selected on the account paperwork, it’s a good idea to review. I stress that part because the beneficiary election you make on account paperwork usually takes precedent even if you have a will. That makes this an incredibly important item to pay attention to, and it’s easy to overlook.

Naming beneficiaries and deciding between per stirpes and per capita is important for more reasons than your untimely death. Remember, retirees with a well-crafted withdrawal plan have significant chance of leaving money to heirs eventually. That makes the issue of beneficiary designations very important.

If you are going to choose between two options you clearly need to know what they mean…

What Does Per Stirpes Mean?

Per stirpes is a pretty awkward looking term. It sounds even awkwarder. Ok… that one’s not a word but I’m going to roll with it.

Awkwardness aside, this little phrase is important to understand to make sure you make the right beneficiary designations.

A per stirpes distribution means that each beneficiaries heirs inherit their share of the account (or estate if in reference to an estate) in the event of the primary beneficiaries death.

It’s easier to understand with a picture…

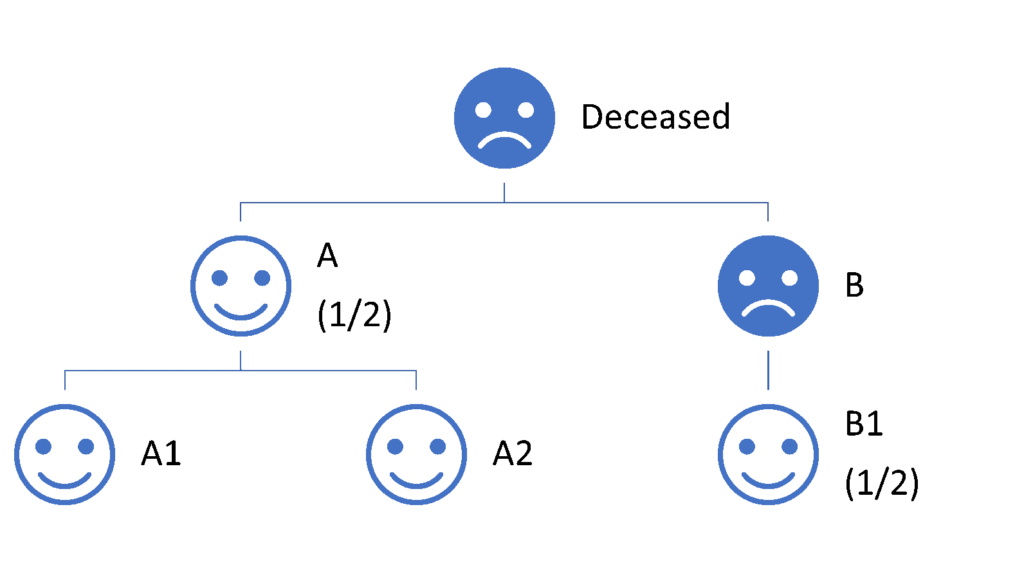

Example #1

Take the scenario below in which a person dies leaving their money equally split between two beneficiaries A and B. If A and B are both alive, they would each get half of the estate. Beneficiary A has two children while beneficiary B has one.

However, suppose that beneficiary B has also passed away. B’s child would inherit the half of the estate that would have gone to beneficiary B. B’s child is a contingent beneficiary. Beneficiary A still has their half.

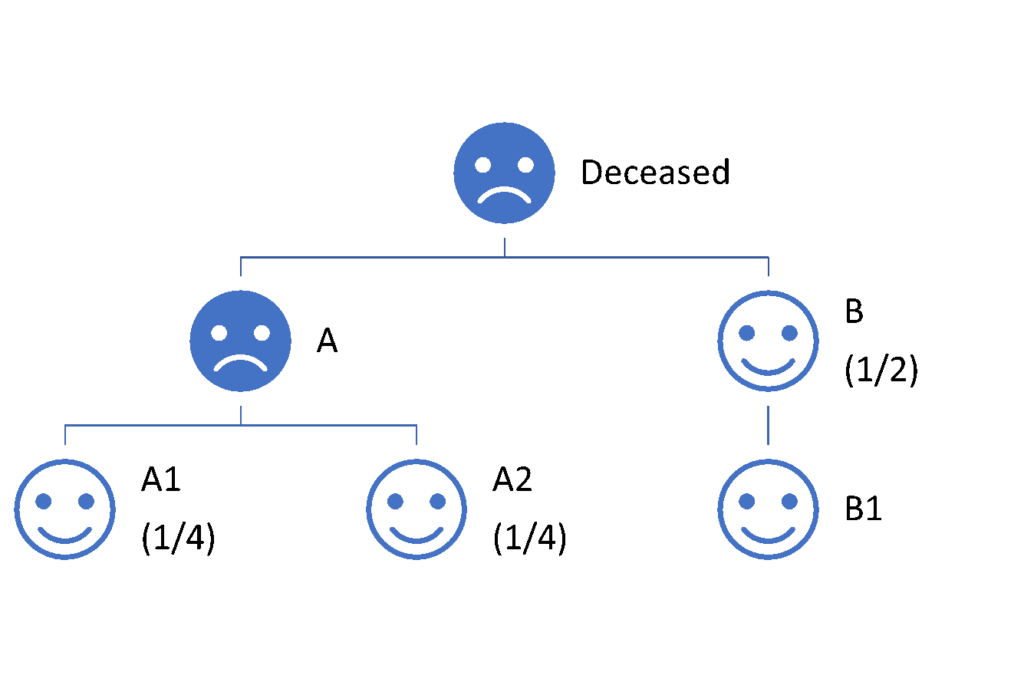

Example #2

Now assume that beneficiary A is deceased, but beneficiary B is not. Since beneficiary A has two children they will each split A’s half of the estate. They will each get 1/4 of the original estate.

If three people were named beneficiaries – A, B & C, the process would be the same. A, B, and C would each get 1/3 of the account.

In the second example where we consider A to predecease the original account owner then A’s children, A1 and A2, would split A’s 1/3 to each receive 1/6.

What Does Per Capita Mean?

When you distribute your money and property (whether from an account or estate) to your beneficiaries per capita, you leave everything to the primary beneficiaries.

If one or more of the primary beneficiaries is no longer alive at the time your estate is distributed, the remaining primary beneficiaries will divide the estate equally.

This is much simpler to understand than per stirpes.

Go back to the examples above. If either A or B predecease the original account owner, the other named beneficiary inherits the entire account.

If there were three named beneficiaries – A, B, and C, and A passed away before the original account owner, B and C would each inherit 1/2 of the account.

The key thing to understand with a per capia election is the money does not pass to the next generation. It is simply redistributed among any living primary beneficiaries.

Review Your Primary and Contingent Beneficiary Selections

Again, your beneficiary selections on account paperwork will usually determine how the account is distributed even if your will says otherwise.

Make sure to review your contingent beneficiary designations periodically. Marriage, divorce, births, and deaths are all common reasons that beneficiary designations may need to change.

Any changes you want to make to per capita or per stirpes elections are simple to fix too. If something has change and you need to change your election, a simple sheet of paper is usually all that is required.

Which Should I Choose? Per Stirpes vs. Per Capita?

It’s largely a matter of personal preference. Who do you want your money to go to? Do you want it all to pass to to the next generation? Do you want to leave equal amounts to different branches of the family?