Asset allocation is the next step in the investment process. In the simplest terms, it means deciding how much of your savings to place in various types of stocks and bonds. At the highest level we think of it as the balance between stocks and bonds. For example, 60% stock and 40% bonds or 80% stock and 20% bonds.

Think of investing in two steps:

- Decide which index funds to include in your portfolio.

- Choose how much of your portfolio to place in each one.

After you decide which investments to include in your portfolio, you need decide how you want to combine them. Your asset allocation has a much greater impact on your investment performance than the individual investments you pick.

The asset allocation process is as much about managing risk as it is about investment performance. With this process you can deliberately manage your risk.

If you haven’t already read the article on index investing, do that first. In this article I’ll explain the asset allocation process as well as WHY it makes sense to follow an asset allocation strategy.

After you read both articles, you’ll understand why investing doesn’t have to be an emotional guessing game.

What is Asset Allocation?

Your asset allocation is your investment mix. We tend to think of asset allocation in terms of percentage weights in a portfolio.

We can start with a simple example of a balance between stocks and bonds. Let’s say you have a $500,000 portfolio. If $350,000 is in stocks and $150,000 is in bonds, that is 70% stock and 30% bonds.

This basic division between stocks and bonds is incredibly important. At this level, you can already start to think about how you are balancing risk and return.

The ability to systematically balance your risk and return is the main advantage of an asset allocation strategy. You get to choose the combination of risk and return that is best suited for you and allows you to reach your goals whether that is saving for retirement or making sure your money lasts throughout retirement.

Let’s see how this works by comparing two different asset allocations.

Return

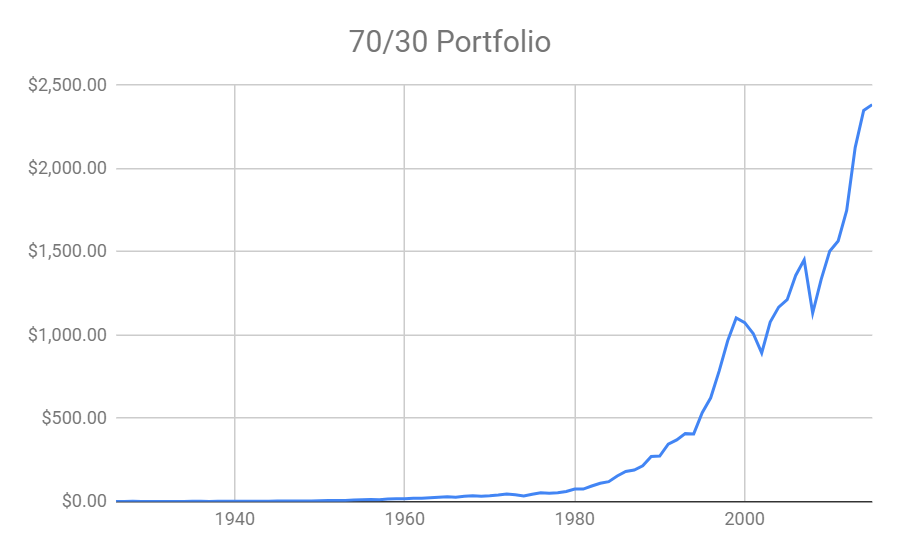

Consider that 70/30 portfolio we just mentioned. From 1926 to 2015 a 70/30 portfolio had an average annual return of 9.96%.

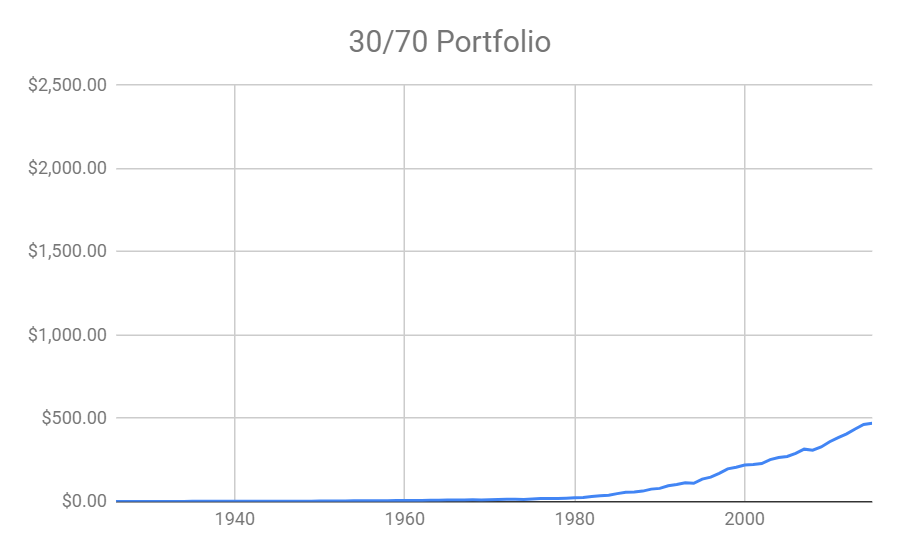

Now, reverse the portfolio weights. A portfolio made up of 30% stock and 70% bonds had an average annual return of 7.31% over that same period.

Clearly, the 70/30 portfolio outperformed the 30/70 portfolio over that period. You can see that in the charts below. Each chart shows the value of $1 invested in 1926.

What about Risk?

In order to get a higher return, you must be willing to accept more risk. In the context of portfolio management, this means greater fluctuation in your portfolio from year to year. If you accept some risk in your portfolio, you increase the chance that you will capture gains due to the market risk premium.

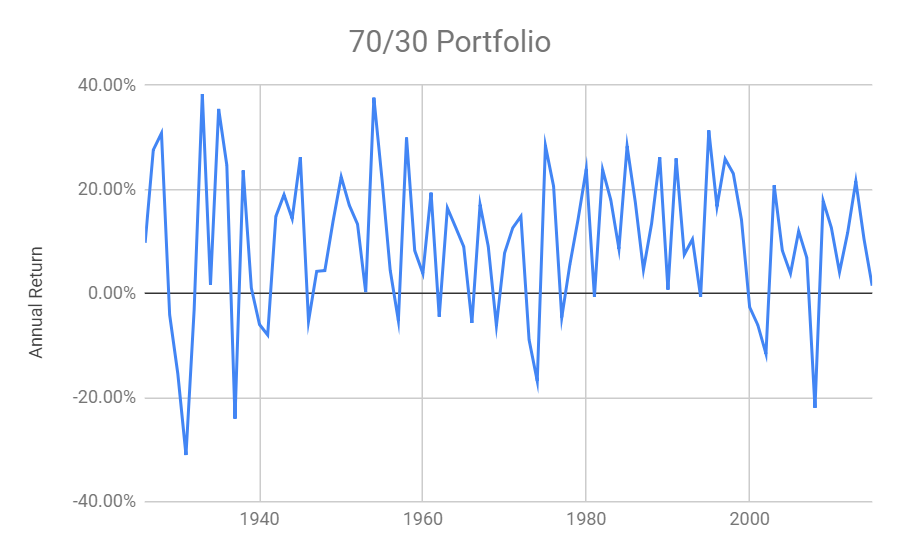

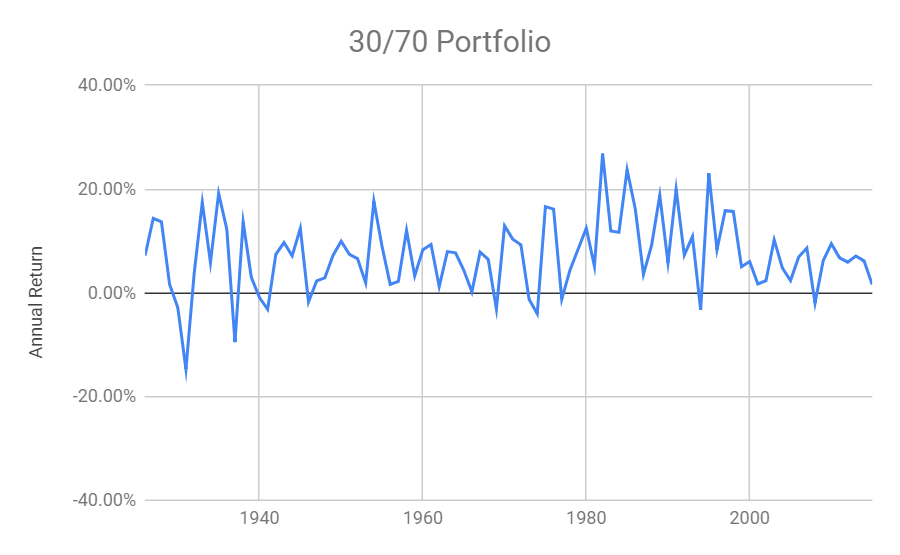

An easy way to see the difference in the two portfolios is to look at the maximum gain and loss of each during the period.

| 70/30 | 30/70 | |

| Biggest Loss | -31.03% | -14.63% |

| Biggest Gain | 38.34% | 26.84% |

But what about the other year’s returns? The chart below plots the annual return of each portfolio. Notice the variability. The 70/30 portfolio fluctuates much more than the 30/70 portfolio.

Not only is the maximum gain and loss substantially different for each portfolio, but the annual fluctuations are substantially different as well.

You can also measure risk as the standard deviation of the returns. If you aren’t familiar with standard deviation, don’t worry. It isn’t really that complicated. Standard deviation is the average difference between any given one-year annual return, and the average annual return. It tells you how much the portfolio value typically fluctuates.

An example…

I know this isn’t statistics class, so I’ll forego the calculation and give you an example. You don’t need to remember the math below for this to be useful to you either. As long as you can grasp the concept behind it, you can use it. I’ll summarize after the example.

The 70/30 portfolio had an average annual return of 9.96% and a standard deviation of 14.05%. This means that the annual return, on average, fluctuated between -4.08% and 24.01%.

(9.96% – 14.05% = -4.08%) and (9.96% + 14.05% = 24.01% )

Compare that with the 30/70 portfolio’s average return of 7.31% and standard deviation of 7.08%. This portfolio’s return, on average, fluctuated between .23% and 14.39%.

(7.31% – 7.08% = .23%) and (7.31% + 7.08% = 14.39% )

Notice the difference in the ranges. When you round to the nearest whole percentage, the 70/30 portfolio had a 28% range (-4% to 24%). The 30/70 portfolio had a 14% range (0% to 14%).

This means that the 70/30 portfolio was twice as risky as the 30/70 portfolio. You can also see that in the standard deviation itself: 14% vs 7%.

The essential concept is: To get a higher investment return, you have to be willing to accept more risk which means greater fluctuation in your portfolio from year to year. The good news is, we can calibrate this through the asset allocation choice.

Combining Return and Risk

Before we start looking at this in a little more detail, I want to point out that what we have just done is frame the investment decision. When you look at investing through the lens of asset allocation and index funds, you choose portfolios based on their combination of risk and return – not whimsical guesses or fun and excited stories pitched by some “influencer” on social media or what your cousin or fishing buddy have dreamed up.

What About Other Asset Classes?

Now that we have the basic idea of asset allocation, lets talk about which asset classes to include. The two assets mentioned above are:

- Stocks

- Bonds

There are other asset classes, and these can be split even finer but I intentionally kept it basic. If I threw it all at you at once you would feel like you were drinking from a fire-hose.

However, there is more to asset allocation than stocks and bonds. You need to think about which stocks and bonds you want to include.

The stocks and bonds I used in calculating the examples above are:

- Large US Stocks

- Intermediate-Term Government Bonds

There are many other asset classes you can, and should, include in your portfolio. Once you think about your basic split between stocks and bonds, you can further divide your portfolio between these other asset classes.

Examples of other asset classes are: Small Stocks, Large International Stocks, Emerging Market Stocks, Long-term corporate bonds, and T-bills.

Again, you can easily invest in each of these asset classes with a low-cost index fund.

Why Include Different Asset Classes?

When you include other asset classes in your portfolio, you get even more diversification. Index investing gives you diversification WITHIN an asset class. Choosing multiple asset classes give you diversification ACROSS asset classes.

You can also increase your average return. For example, from 1926-2015 small US stocks had an average return of 16.47% and a standard deviation of 32%.

Which Asset Allocation Do I Choose?

Before we decide which portfolio to choose, its important that you understand HOW to choose. First, let’s look at our options.

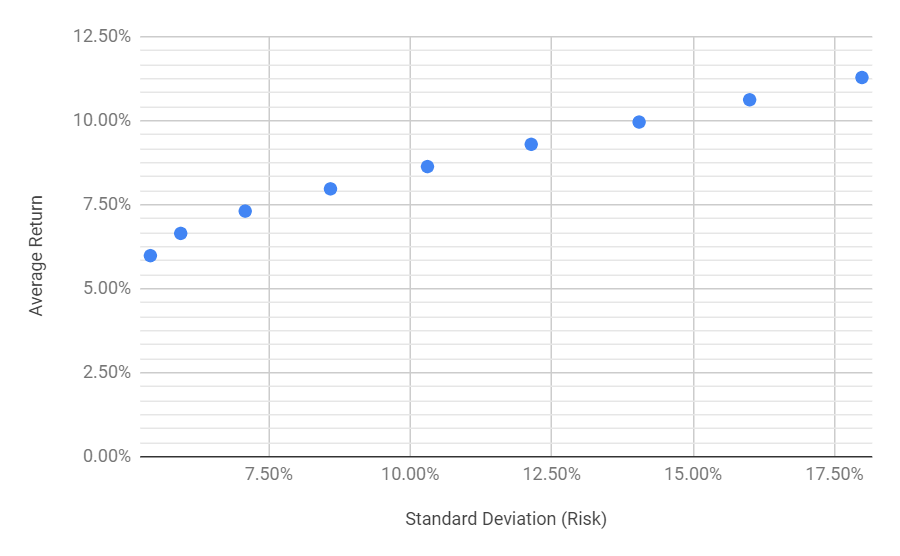

In the chart below I’ve plotted asset allocations from the same data as in the first example. From left to right you see the following allocations: 10/90, 20/80, 30/70, 40/60, 50/50, 60/40, 70/30, 80/20, and 90/10.

Notice the relationship between risk – standard deviation – and return. As the average return increases, so does the risk. Your asset allocation choice is based on this trade-off.

So, which one do you choose? You choose the portfolio that gives you the ideal balance between risk and return. Could I be more vague? Probably, but I’d have to try real hard!

I’ll provide more guidance in a moment after this section on Modern Portfolio Theory.

Modern Portfolio Theory

This analysis was developed by Harry Markowitz in his 1952 paper Portfolio Selection. It was the result of his doctoral dissertation that he completed under Milton Friedman. In his research, Markowitz describes what he calls the “efficient frontier”.

The efficient frontier represents all the possible efficient asset allocation options that are available. An efficient portfolio is one that:

- Provides the highest expected return for a given level of risk.

- Minimizes risk for a given level of return.

ANY portfolio that lies on the efficient frontier can be a “correct” choice for you.

The chart above is essentially the efficient frontier of our two-asset-class portfolio. Although it was developed in 1952, his process is still known as Modern Portfolio Theory.

Choosing the Asset Allocation For Your Retirement

Determining which portfolio is best for you is much more about YOU than it is the portfolio. You may also find that you want to change your asset allocation over time*. Don’t think of this as a one-time decision but as an evaluative process.

The end goal should be that you have a portfolio that aligns your investment plan with your retirement plan. That way you aren’t tempted to change it based on market conditions or recessions.

Some of the main factors you need to consider are:

Risk Tolerance

What is your appetite for risk? When you see your portfolio value fall 20% in a year do you panic and sell? If so, you should choose a portfolio with less risk. There are a lot of factors that affect your risk tolerance.

To some extent, educating yourself on the investment process can help you stomach a little more risk if you need to. It can also help you avoid risks that you otherwise wouldn’t understand and may not know you are taking.

Time Horizon

How long will you be invested before you need to take withdrawals? The longer your time horizon, the more risk you can take in your portfolio. Over a longer period, the potential for a higher average return should make up for the fluctuations in your portfolio. Remember the example above.

Return Objectives

What rate of return do you need or want? If you want a higher return, you’ll need to choose a portfolio further to the right on the efficient frontier. Remember, this comes with increased risk.

With just these few factors, you can see that the decision requires balancing competing aims.

*Be careful not to change your allocation based on the market. Notice that at no time have I mentioned choosing an allocation based on what the market is expected to do. Your asset allocation is based on factors specific to YOU. One of the main benefits of an asset allocation strategy is it takes a lot of the emotion and guesswork out of investing.

What About Investing for Retirement Income?

Index fund allocations provide a good means of investing. This is especially true before you retire, and your main concern is building up your nest egg.

Once you start to transition into retirement index fund allocations are still good, but you do need to think specifically about how your investment strategy supports your retirement withdrawal strategy.

The risks you face before retirement are not the same as the risks you face in retirement. Before retirement you are contributing to a portfolio. During retirement, you take withdrawals from the portfolio. Even this simple reversal changes your risk.

Depending on your withdrawal strategy you may need to adjust your portfolio. For example, if you use an income floor strategy.

However, index fund allocations can still provide the basis of your portfolio.

Which Asset Allocation Should I Choose?

Need help deciding on the retirement asset allocation that works best for you? Email me at [email protected] or call 903-471-0624 and we will get started.