What is sequence of returns risk? We often think of investment return as an average rate over some period, such as 10, 15, or 20 years. This is especially true regarding investment returns within a retirement planning context where the investment horizon is often very long.

Anyone interested enough to be reading this knows that investments are volatile and do not generate returns in a strict, consistent, uniform manner. Instead, investment returns fluctuate. In some periods an investment (or portfolio of investments) may return much more than it’s average. In other periods, the investment may produce a return that is very near, or much less than, it’s average.

An example of an investment with a 5% average rate of return may produce annual returns over a four year period of: 7%, -2%, 3%, and 12%.

The order in which these varying rates of return occur is known as the sequence of returns.

I know… it’s very creative.

This sequence of returns exposes you to a particular type of risk.

How does the sequence of returns affect my portfolio?

When you make a single initial investment with no subsequent contributions or withdrawals, the sequence of returns does not have an impact on the total value of the portfolio.

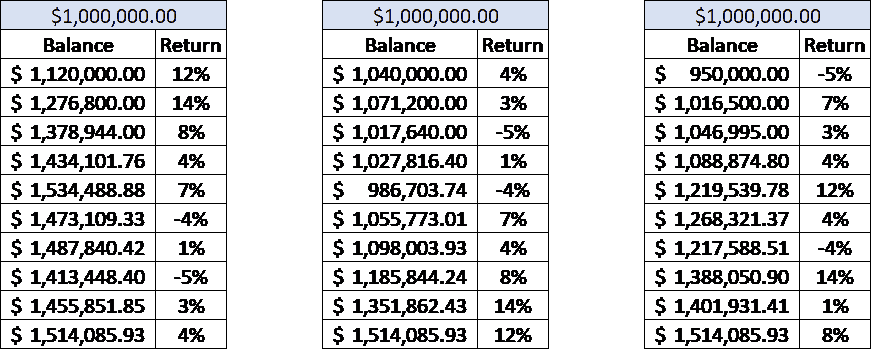

In the example below, you make a $1,000,000 initial investment. The individual annual returns for each portfolio are the same, but in different sequences. The second sequence is reversed from the first one, and the third is randomized.

Notice that the final value of each portfolio is the same, regardless of the sequence of returns.

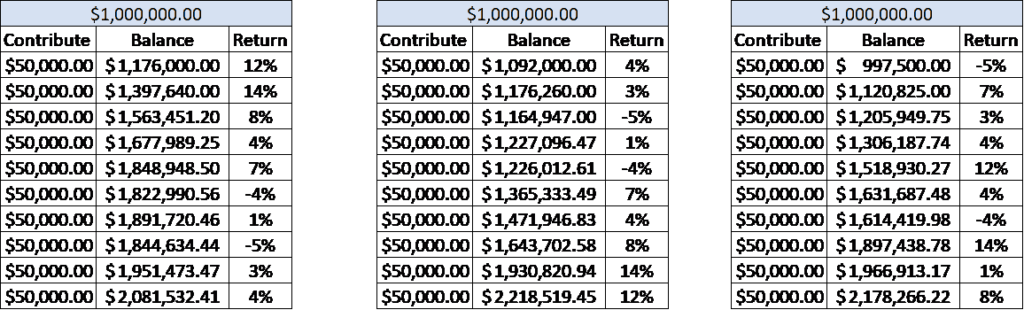

However, the sequence of returns absolutely matters when you make contributions to, or withdrawals from, a portfolio. In the next examples, we start again with the initial $1,000,000 and the same three sequences are used. However, we contribute an additional $50,000 each year to the portfolio. Notice how the final value of each portfolio is now different. Since nothing else about the scenario changed we know that the resulting change is due to the differences in the sequence of returns.

Why does the sequence of returns affect the value of a portfolio when contributions are made?

To see why the sequence of returns has an effect on the final value of a portfolio when contributions are made, look at the first tables in the contribution example.

Note that in the first table the higher returns generally come first in the sequence.

Compare that to the second table, and you’ll notice that the higher returns come later in the sequence.

Since there are ten periods in the sequence, you can simply split each sequence in half. This illustrates the difference in the average return of the first half compared to the second half.

Timing of Contributions

Now consider the timing of the contributions. In the first sequence, the higher returns come sooner, before many of your make many contributions. The first two periods of high return, 12% and 14%, only apply to two of the contributions, because the remaining eight have not been made yet. Now consider the last two returns in the sequence, 3% and 4%. These two returns occur after nine and ten contributions have been made and therefore affect a much larger amount.

The key takeaway here is that during the contribution phase of a retirement plan, larger returns have a greater impact when they come later.

Taking withdrawals in retirement

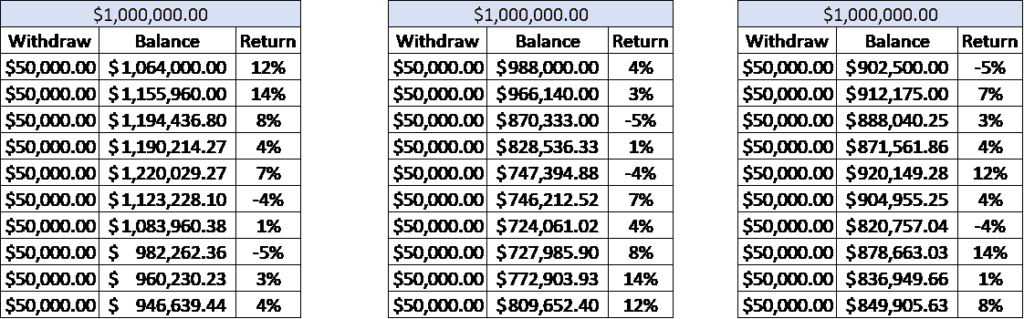

The sequence of returns significantly impacts the value of a portfolio when you withdraw from the portfolio as well. In the next example, the numbers remain the same except that now I am using it to illustrate what happens when you retire and start to draw down the portfolio in order to generate retirement income. Therefore, instead of a $50,000 annual contribution, you are taking a $50,000 withdrawal to cover retirement spending needs.

Notice again that the three different sequences, although comprised of the same individual returns, result in different final investment portfolio values.

Specifically, look again at the first two sequences. Notice that the second sequence no longer results in a more valuable portfolio as it did in the contribution example. The first sequence results in a more valuable portfolio during retirement when you make withdrawals.

Nothing has changed conceptually. The same analysis as before applies here, but everything is happening in reverse.

In the first sequence, the larger returns come first BEFORE many withdrawals have been made and therefore affect a larger amount of your retirement savings. In the second sequence, the larger returns come AFTER you have made a substantial number of withdrawals. Therefore, they affect a smaller portion of your retirement savings. In the second sequence, you have already withdrawn $450,000 (9 x $50,000) before the 14% return period.

How to reduce your exposure to the sequence of return risk in retirement

Understanding how the sequence of returns affects your retirement account value, and therefore your ability to generate retirement income, helps. This is true because understanding the risk is necessary to develop a strategy to protect yourself.

There are a number of dynamic and a bit more complex ways to handle sequence of returns risk, but I note two conventional ways below.

Reduce equity exposure near retirement

Conventional practice is to reduce your exposure to equities the closer you get to retirement. This makes sense from a risk-tolerance standpoint. The closer you are to retirement, the closer you are to relying on your savings for retirement income.

This also makes sense given the impact of sequence of returns. In the accumulation phase of retirement planning, poor returns hurt your retirement nest egg worse when they come later – closer to retirement. If you reduce your exposure to equities closer to retirement and instead opt for more fixed income (bonds) in your portfolio, you will not be as affected by falling stock prices.

You will then also have less equity exposure when you cross the line from accumulation to retirement and starting taking withdrawals from your retirement account. Since poor returns cause greater harm in the beginning of this phase of the retirement plan, you reduce your exposure to sequence of returns risk by reducing your exposure to equities in the beginning of the retirement withdrawal period.

You can also invest a portion of your retirement savings in bonds to develop an income floor with bonds.

Delay retirement to avoid taking withdrawals during periods of poor market return

Another way to reduce exposure to sequence of returns risk in retirement is to simply delay retirement. If stock returns are poor in the year in which you had planned to retire, try to wait. Instead of withdrawing retirement income during a year with poor market performance, you can delay until the market is better. Of course, this may not be a very enticing option.

Use a MYGA

A MYGA, or multi-year guaranty annuity can let you lock in a series of payments for a fixed number of years. For example, maybe you purchase a MYGA to cover the first 3 years of retirement. Then, if the market tanks just as you retire you have protected your portfolio from potential withdrawals.

The main drawback to a MYGA is that the rates of return are quite low. In effect, you give up the chance for growth in exchange for protection from a decline.