If you are nearing retirement, or already there, then “recession” can be a scary word. It can be an even scarier experience. It’s understandable that you are concerned about how it will impact your retirement savings. However, it doesn’t have to mean doom and gloom.

In this article, I’ll give you some context to help you understand how a recession might affect you, and explain what you need to consider if you are wondering what you should do with your retirement money.

How to Invest Retirement Money in a Recession

Let’s address this concern right out of the gate since it’s usually the first thing on someone’s mind when they start thinking about recessions and retirement. The idea goes something like this:

“If there’s going to be a recession, I should move my money into something safe and wait until the market recovers.”

-everybody and their dog when there’s talk of a recession

Sounds reasonable enough. The critical problem though is that you simply can’t time it accurately enough to actually do it that way. It’s not because you are dumb or that you don’t know how – it’s just not possible. I explain why in this article on the reasons I like index funds so much.

Basic human psychology is working against you too. All of this means that if you try to dance around market movements, you’ll probably end up locking in losses and then missing out on gains when the market recovers. Think about it… The reason you’re reading this to begin with is probably because you’re at least worried about the market and are thinking about selling or changing your investments.

However, if you’ve invested correctly to begin with then you probably don’t need to change anything. Your investment plan already accounts for the chance of a recession. If that doesn’t apply to you, it’s time to get that way.

I’ll explain what I mean by that.

How Should I Invest for Retirement?

Think of your investment strategy as a sub-component of your retirement plan. The way that you invest should be crafted to support your broad retirement goals. It shouldn’t be about randomly chasing investment returns – although many novice investors think of it this way.

Once you’ve invested appropriately, don’t change things every time the news media publishes an exciting headline or your co-workers tell you it’s time to freak out about the economy. (Refer back to what I said in the previous section.) Will you need to shift some things around? Probably.

But that is to put your portfolio back into alignment. In other words, as the market fluctuates you will need to put things back in order the way they should be according to your plan. We call this rebalancing.

To do this, you first have to have a real retirement plan that includes things like your expected retirement age, spending needs, sources of income (savings, Social Security, and pensions), housing, taxes, and health care expenses.

Asset Allocation

Next, align your investments with that retirement plan. How, exactly? The best way to match an investment plan to a retirement plan is to make sure that you have the right asset allocation. You can click the link to another article in which I explain that, but it basically means that you select the mix of investments that balances risk and expected average return that is best suited for you and your plan. This partly what a standard risk tolerance questionnaire is for – to help guide you to the right portfolio.

At a high level, we are talking about your mix of stocks and bonds. This is most often represented as a percentage such as 60/40 which means 60% of your investments are in stocks and 40% are in bonds.

Think a little deeper about why you are concerned about your investments. It’s probably more about wanting to know that you are going to be able to retire and live the way you want to. Rather than thinking about what your investments are doing from month to month, lets rephrase the question to be about whether or not you are still on track for retirement.

Once you have a complete retirement plan in place how do you know if you’re on track?

How Do I know if I’m on Track for Retirement?

One of the many benefits of investing in a broadly diversified portfolio is that it gives you data to use to track your retirement plan. Specifically, it allows you to use the average return and fluctuation behavior of your chosen asset allocation.

The behavior (volatility) of your investments is just as important as the expected return. It allows you to see how your chosen portfolio has tended to fluctuated over time. This is critical for helping you stay the course during rough markets or recessions.

For example, from 1926 to 2015 a 60/40 portfolio had an average return of about 8.5% per year. It also fluctuated by about 12% on average (a measure called standard deviation). That means that anything between -3.5% and +20.5% in a year would simply be a normal year!

Why is that important to understand?

Because most people worry too much about year-to-year portfolio values, while at the same time failing to incorporate typical fluctuations into their retirement plan when they are following a “chase returns” investment strategy.

One More Reminder…

Your asset allocation choice determines your exposure to risk as well as your expected average return. Remember that it’s impossible to predict the market. So, you need to choose a portfolio that you can stick with during good markets and bad.

For example, over that same period a 40/60 portfolio had about a 7.6% average return with a 8.5% standard deviation. Notice that when you compare the 40/60 with the 60/40 that the portfolio with the higher average return also has the highest standard deviation? That relationship is a constant. The more aggressive your portfolio is the higher your expected return will be, but the more it will fluctuate.

You can’t have the 8.5% average return of the 60/40 portfolio with the 8.5% standard deviation of the 40/60 portfolio!

Planning with Data

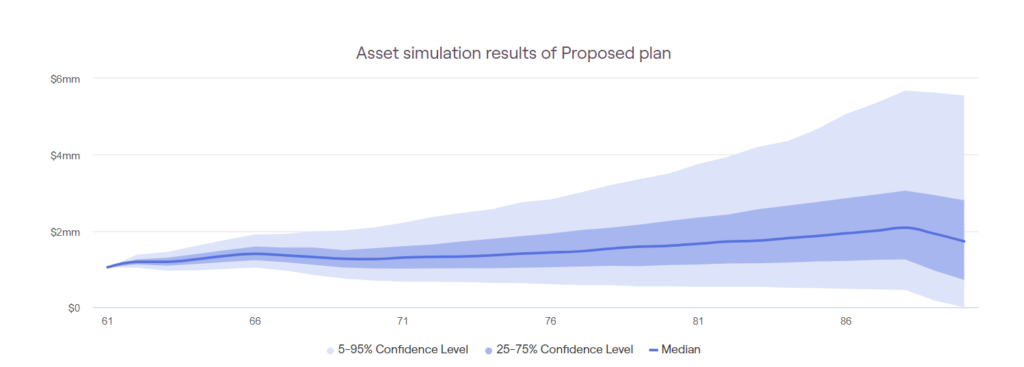

So how do you incorporate this portfolio behavior into a long-term retirement plan? I’m a fan of a process called Monte Carlo analysis. That’s a fancy sounding name with even fancier looking math, but I’ll explain it simply.

Instead of using a single return estimate such as the 8.5% or 7.6% mentioned above for every year, Monte Carlo analysis uses average return of your portfolio as a starting point, and randomizes the returns every year by standard deviation.

Your return estimate changes for every year of your plan. For example, maybe the first year is 8.5%, the second year is 22%, the third year is -8%… and so on.

Suppose you have a 30 year retirement. That means that you estimate a different return for each of the 30 years.

Then, you can see what your portfolio might be worth across the entire range of return estimations over time.

It also runs MANY trials so that you are looking at more than one future sequence. There isn’t a set number of trials you have to run, but I do 1,000. In other words, you end up with 1,000 different 30-year sequences of randomized return estimates.

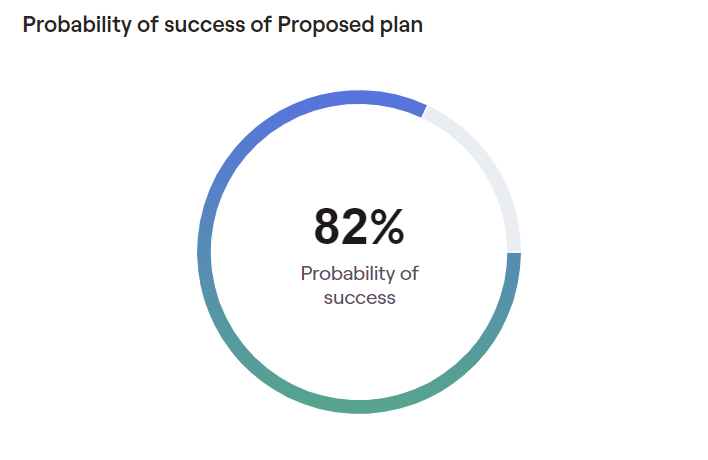

I then look at each of those 1,000 sequences and say “Ok, in how many of these sequences does the plan work without making any changes?” Maybe 700 out of 1000 work. Maybe all 1000 work.

I generally like to see about 800 of the sequences work. In other words, an 80% probability that everything works out with no changes required. But, there’s no right answer and you should aim for a number that you are comfortable with.

The first question I always get is “Why not 100%? I want to KNOW that it’s going to work.”

Because that other 20% are the worst case scenarios of those random trials, and your plan is a living and adaptable thing. If you get going along and things start to look like you might be drifting toward that bottom 20% you can usually “fix” it by making a few small tweaks.

That’s where the benefit of planning comes in.

If you shoot for a 100% probability, then you are almost certainly working longer than you need to, or spending less in retirement that you can afford to.

So What Does All of this Mean?

Which brings us back to the beginning.

If you have a true retirement plan and are tracking it (or have a nerd like me tracking it for you) then you have already accounted for a range of “what-ifs” that include the occasional recession. In other words, a recession or bad market is no surprise to your plan.

Does that mean you don’t need to do anything in a recession or bad market? Not necessarily. If your probability of plan success is high enough then yes you can keep on doing what you are doing. If it isn’t, then it may be time to think through what you might can change to get back on track.

Maybe that means you delay retirement. Maybe that means you cut back on your spending. Forego a vacation one year. Whatever – you get the idea. There are many ways to go about it. It’s about figuring out the best way for you.

To get help from a fee-only fiduciary and make sure that your investments align with your retirement plan, email me at [email protected] or call 903-471-0624 and I’d be glad to help you.