The Capital Asset Pricing Model, or CAPM, is a basic theoretical model for determining the expected return on a security or portfolio. This CAPM calculator will allow you to quickly find the expected return on a stock using the CAPM.

I provide a short explanation of the CAPM first, but you can just scroll down to the calculator if you already know how to use it.

What is the CAPM formula?

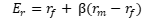

The Capital Asset Pricing Model formula relates the expected return on a stock to it’s risk and the expected return on the market based on the following CAPM equation:

This formula states that the expected return on a stock equals the risk-free rate plus the stocks beta times the return on the market minus the risk-free rate.

The CAPM Explained

Here is what that means in plain English:

The risk-free rate is the rate of return you can expect to earn on a riskless investment. Generally, the yield on a 6-month Treasury bond is how we estimate this, but you can use whichever maturity you think is appropriate. The idea is that since the interest and principal on a Treasury bond are backed by the U.S. government’s ability to tax, there is virtually no chance they won’t be repaid. Kinda leaves a sour taste in your mouth doesn’t it?

The Greek letter beta represents the stock’s risk relative to the market as a whole. It’s a ratio, so if a stocks beta is 2 that means it is twice as risky as the market. If the beta is .5, then the stock is half as risky as the market.

The part inside the parentheses is what we call the market risk premium. It’s simply the return on the market minus the risk-free rate of return. We typically use the return on the S&P 500 as the “market” return. It’s really pretty simple. If the market return is 10% and the risk-free rate of return is 2%, then 10%-2% is 8%, which is the market risk premium.

CAPM Example

Now, let’s put it all together in an example. Suppose the risk-free rate of return is 2%, the return on the market as measured by the S&P 500 is 10%, and your stock has a beta of 2.

The expected return on that stock per the CAPM is:

2% + 2(10%-2%) which simplifies to: 2% + 2(8%) which equals 18%.

CAPM Calculator

How to Use the CAPM Calculator

To use the calculator you need to simply plug the values that you want to use into the appropriate field.

For the risk-free rate you can find current treasury yields here.

There is a lot more to be said for beta and how you calculate it, but for practical use and simplicity you can simply look up a stocks beta on Yahoo! Finance.

Lastly, you need a measure of the market return. While all of these values should be the forward values, we obviously can’t predict the future. Instead, we generally let historical data serve as a proxy for the future. You can find historical S&P 500 return data for any period you would like here.