Living happily in retirement means crafting a spending plan to support your lifestyle. To do that, you’ll need to think about how you plan to live in retirement. Not just now, but for the long term too. That could involve a plan to spend more early in your retirement.

While you can’t know for certain what the next several decades will hold for you, it’s a good idea to make some reasonable estimations.

How long will you live? Will you age well physically, mentally? How active will you be in your 60’s vs your 80’s? Those are all things to consider, because they all affect your retirement spending plan.

There are also a few general guidelines you can consider.

For instance, most retirement spending plans account for inflation. The basic idea is to adjust your annual withdrawals by inflation so that you can purchase the same things you did before. That makes sense considering inflation will push the cost of goods and services up over time. This works perfectly well for some retirees.

However, it isn’t the only way to plan for long-term retirement spending.

Retirees Typically Spend Less as They Age

Retiree spending patterns typically decline over time. This is really pretty reasonable considering the typical retiree is in their 60’s when they first retire.

If you retire while you are still young enough to live an active lifestyle, your spending may not decline very much early on. In fact, with increased time to travel you could even spend more in the first few years of retirement than you spent when you were still working.

There isn’t anything wrong with this spending pattern. Many will consciously choose to spend more in the earlier years of retirement, even if it means they have less to spend later. That’s ok.

You will naturally slow down as you age. We all will.

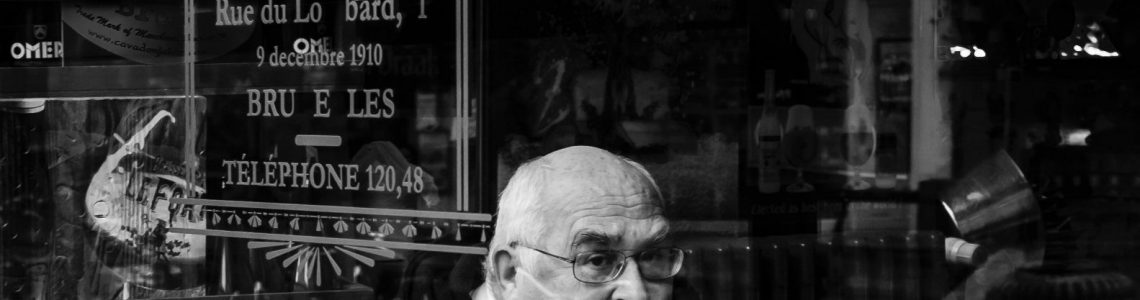

I remember sitting in the hospital with my grandpa when he broke his hip in 2018. He was on the verge of 90.

One thing was very clear. He wasn’t interested in spending on much of anything. Least of all, clothing. He was still sporting his Perot ’92 campaign t-shirt. Of all of his shirts, this was my wife’s favorite. He was prone to tuck it into his sweatpants for fancy occasions.

He wasn’t destitute by any stretch of the imagination, he had simply quit caring about his wardrobe.

He had been retired for most of my life. I only vaguely remember him working at the body shop he owned with his brothers. What I do recall very well was that he had always been an avid gardener and hunter, but he slowed down in his late 80’s. In the last 5 years of his life I don’t know that he did ANY hunting or gardening.

Again, this is quite typical.

What Does the Data Show?

Take a look at the age-group spending data from the Bureau of Labor Statistics Consumer Expenditure Survey.

| Age Group | 45-54 | 55-64 | 65-74 | 75+ |

| Average Spending | $73,905 | $64,972 | $54,997 | $41,849 |

Notice the continual decline in spending by age group.

Some of this isn’t good. No doubt this includes some retirees who simply didn’t plan well and were forced to spend less in retirement.

However, this also shows the natural effects of aging.

Planning for Declining Spending

If you plan to spend more in your early years and less in your later years you’ll want to make sure that you have a structured plan to achieve that. It’s one thing to SAY you will spend more now and less later. It’s another to make sure that your “now” spending doesn’t completely ruin your “later” spending.

You’ll still need to eat when you’re 85… even if you’re wearing your Perot ’92 shirt.

Retirement spending is always a balance between how much you spend and making sure the money lasts as long as you need it to.

But how do you account for that? Basic retirement withdrawal strategies like the 4% rule plan for even spending over your entire retirement.

That’s ok, and is certainly safer, but it doesn’t allow you to “spend now while you are still young enough to enjoy it”.

Neither way is universally “correct”. The spending pattern you plan to follow should reflect the way that YOU plan to live in YOUR retirement. What’s important is that your plan supports your lifestyle, and that you form a plan based on sound reasoning.

In the next few sections I’ll introduce some simple ways to plan for a higher level of spending earlier in retirement.

Segment Your Portfolio by Retirement Phase

Think about going through your retirement in three distinct phases – “go-go”, “slow-go”, and “no-go”.

Your go-go years are the years you plan to be very active. Naturally, you’ll spend more. In the slow-go years you are still active, but not as much as you were in the go-go years. In the no-go phase your activity is more limited.

You cant segment your portfolio into three parts, and treat each part as though it’s purpose is to provide income for a particular phase.

Social Security & Pensions

Social Security benefits and other pensions that pay out for life could provide you with some minimum amount of income in your later years. If you think yours will be enough to live on, simply plan to spend your retirement savings sooner than your lifespan. This will mean you’ll spend more each year.

Let’s look at a simplified example to illustrate this idea.

Say you are retiring at 65 and estimate that you’ll live to be 95. You also estimate that you’ll slow down considerably at 85 and will only need to account for basic living expenses, and that Social Security will be enough once you turn 85.

Instead of using a withdrawal plan that takes you all the way out to 95 (30 years), you could use a withdrawal plan for 20 years.

If your portfolio only needs to last 20 years, you’ll be able to withdraw more of it each year.

Delayed Bond Maturity

What if Social Security isn’t quite enough? You can make up the difference with bonds that will mature after you spend the rest of your savings. This is a simple variation on the income floor approach using a bond ladder.

Again, using our example from above, you could buy bonds that start maturing when you turn 85. This is a good way to fill any gaps left from Social Security.

Suppose your Social Security benefits leave you with a $15,000 income shortfall in your spending plan. You can purchase bonds with a total maturity value of $15,000. The added benefit here is since the bonds have a known maturity value, you remove a lot of the uncertainty.