Roth IRA’s can be an excellent retirement saving vehicle. Roth IRAs allow you to save $6,00 per year towards retirement if you are under 50. People who are 50 or older can contribute a “catch-up” contribution of $1,000 each year for a total Roth IRA contribution limit of $7,00 per year.

Unlike Traditional IRA’s and other tax-deferred retirement accounts, the Roth IRA allows you to contribute after-tax money. Contributing money that has already been taxed is beneficial because the IRS allows you to withdraw the money, and its accumulations, tax-free.

Income Limits

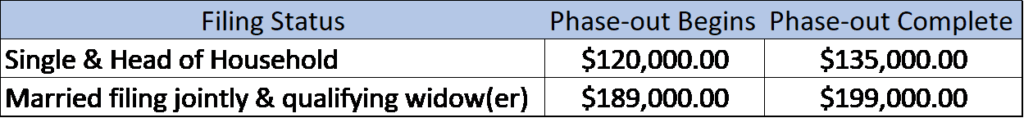

There are certain income (modified adjusted gross income (MAGI), or the amount of your income that your federal income tax is based on) thresholds that, if crossed, reduce or eliminate your ability to contribute after-tax money to a Roth IRA. Refer to the table below:

Depending on your filing status, you can contribute the full $5,500, or $6,500 if 50 or over, if your adjusted gross income is below the amount listed in the “Phase-out Begins” column. Of course, if your adjusted gross income exceeds the amount listed in the “Phase-out Complete” column, you have completely phased-out your ability to contribute after-tax dollars to a Roth IRA. Congratulations, you make too much money or have a bad accountant. Either way, you can’t contribute directly to a Roth IRA. You can still contribute to a Traditional IRA, and convert the Traditional IRA to a Roth IRA. This is referred to as the back-door method.

How to Determine Your Allowable Roth IRA Contribution

Your eligible contributions to a Roth IRA are reduced if your income falls within the phase-out range. To figure your Roth IRA contribution limit:

- Start with your MAGI

- Subtract the income level that begins the phase-out for your filing status ($120,00 or $189,000).

- Divide the remainder by $15,000 if your file Single or Head of Household. Divide the remainder by $10,000 if you file a joint return or are a qualifying widow(er).

- Multiply your result by $5,500 ($6,500 if you are 50 or over).

- $5,500 ($6,500 if you are 50 or over) minus your result in step four is your contribution limit.

Example:

You are single and have a MAGI of $125,000.

- $125,000

- $125,000-$120,000 = $5,000.

- $5,000 ÷ $15,000 = .333…

- .333… x $5,500 = $1,833.33

- $5,500 – $1,833.33 = $3,166.67

Your reduced Roth IRA contribution limit is $3,166.67.