If you save for retirement using tax-deferred accounts then you need to understand the rules surrounding required minimum distributions (RMDs) in order to avoid some pretty steep penalties.

For some retirees, the required minimum distribution is less than they would withdraw anyway, and is therefore not much of a planning concern.

For others who intend to defer withdrawals as long as possible, or simply don’t need to take them, required minimum distributions could be more of a challenge. If you are in this group you need to decide what you will do with your RMD.

Traditional IRA’s, qualified plans (such as a 401k), 403b, 457 as well as SEP and SIMPLE plans are all subject to the required minimum distribution rules. Roth IRA’s are famously not subjected to required minimum distributions but the same does not apply to other Roth accounts such as the 401k or 403b. The IRS specifies the accounts for which RMDs apply.

What are Required Minimum Distributions?

In an effort to encourage people to save for retirement,the internal revenue service rules allow for a number of account types and structures that provide for tax-deferral. By providing tax-deferral, there is a direct and immediate benefit of saving of saving for retirement. This serves an incentive to save, as well as amplifies the benefits of saving.

As long as the money remains inside the tax-deferred account no taxes are collected. Only when the money is withdrawn does the investor incur a tax liability. This is clearly good for the investor who is saving for retirement. However, no tax liability to the investor means no tax revenue to operate the government.

If this tax-deferral occurred in perpetuity, that would create a significant drag on tax revenue, as well as keep a lot of money out of circulation. Required minimum distributions ensure that money inside tax-deferred accounts is withdrawn during the retired life of the account holder.

When do Required Minimum Distributions Start?

Required minimum distributions start when the retiree is 70&½. Specifically, the year in which the retiree turns 70&½. The 70&½ calculation is straightforward: Your 70th birthday plus six months.

If you turn 70 on February 5th, 2018, then you turn 70&½ six months later on August 5th, 2018. You must take an RMD for 2018.

If you turn 70 on September 20th, 2018, then you turn 70&½ six months later on March 20th, 2019. You must take an RMD for 2019.

For your first required minimum distribution you are allowed to wait (not required) until April 1 of the year after you turn 70&½ to physically take the withdrawal. However, don’t mistake this for when the distribution applies. Even if you wait until April 1 of the year after you turn 70&½, the distribution still applies to the year you turned 70&½. You don’t have to wait until April 1 of the year after you turn 70&½ to take your first distribution. You can take it in the year it is required.

To extend the examples from above:

If you turn 70 on February 5th, 2018, then you turn 70&½ six months later on August 5th, 2018. You must take an RMD for 2018. However, you don’t have to actually withdraw the money until April 1 of 2019.

If you turn 70 on September 20th, 2018, then you turn 70&½ six months later on March 20th, 2019. You must take an RMD for 2019. However, you don’t have to actually withdraw the money until April 1 of 2020.

Notice the difference in outcome for these two examples even though the two individuals turn 70 only seven months apart. In fact, you would get the same result if the first person was born on June 30th and the second person was born on July 1 of the same year. This is simply a function of adding six months to arrive at 70&½. If you are born in the first half of the year (by June 30th), then you turn 70&½ in the same year that you turn 70. If you are born in the second half of the year (after June 30th) then you turn 70&½ the calendar year after you turn 70.

The reason is it important to remember that the distribution applies to 2019 even if you take it on April 1 of 2020 is that you are still required to take a distribution for 2020.

You are allowed to take your first distribution by April 1 of the year following the year you turn 70&½. Each remaining distribution must be taken by December 31 for the year it applies.

So, if you wait until April 1, 2020 to take the distribution for 2019, you must still take a distribution for 2020 by December 31 of 2020. In effect, you will take two distributions in 2020.

How much do I have to withdraw?

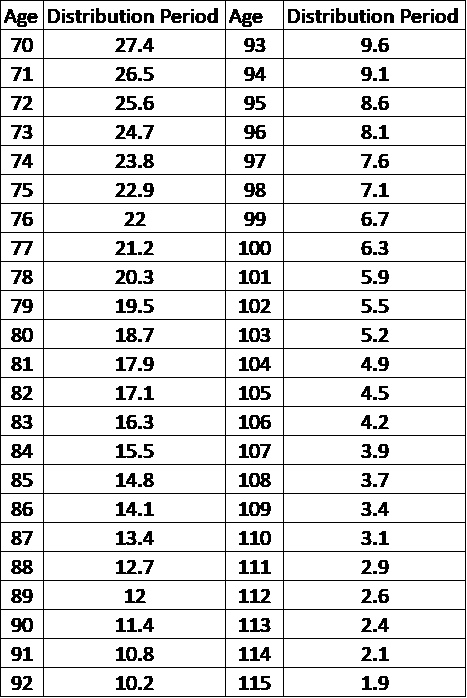

The idea behind the calculation of the required minimum distribution is to withdraw all of the money within the account over your remaining life. Your life expectancy is taken from the IRS Uniform Life Table III provided you aren’t married to someone who is more than 10 years younger than you.

To calculate your required minimum distribution, divide your account value as of December 31st of the PRIOR YEAR by your life expectancy.

The age you use is the age that you reach in the calendar year for which the distribution applies. If you are taking a distribution for 2020, you use the age you reach on your birthday in 2020. You use the account balance as of December 31, 2019.

Taking the example from above:

If you turn 70 on February 5th, 2018, then you turn 70&½ six months later on August 5th, 2018. You must take an RMD for 2018. However, you don’t have to actually withdraw the money until April 1 of 2019.

How much do you have to withdraw on April 1, 2019? Remember, the distribution is for 2018. You first need to know the account balance as of December 31, 2017. Let’s assume it was $1,000,000. Next, figure out your life expectancy from the Uniform Life Table. We already know that you turned 70 on your birthday in 2018. This corresponds to a life expectancy of 27.4 years.

$1,000,000/27.4 = $36,496.35

You would be required to withdraw $36,496.35 by April 1, 2019. (You are not required to wait until April 1, 2019)

This amount will change every year based on the formula.

What if I don’t take my required minimum distribution?

If you don’t take your required minimum distribution, or take too little, you will have to pay a penalty. The penalty is equal to 50% of the amount that you should have withdrawn. In the case above you would owe 50% of $36,496.35 ($18,248.18) if you didn’t take any distributions from your account for 2018. If you only took $20,000 in distributions you would owe 50% of the remaining amount ($36,496.35 – $20,000 = $16,496.35 x 50% = $8,248.18).

Given that the highest marginal tax rate in 2018 is 37%, you are clearly worse off paying the penalty.

What if I’m still working?

You are not required to take required minimum distributions while you are still employed, even if you are over 70&½. If you continue to work past the standard required minimum distribution beginning date then you must take your first distribution by April 1 of the year after you retire. An exception to this is if you own 5% or more of the plan sponsor.

If you turn 70 on February 5th, 2018, then you turn 70&½ six months later on August 5th, 2018. You would normally be required to take an RMD for 2018 by April 1 of 2019. However, you are still employed. You retire in May of 2024. You must take an required minimum distribution by April 1 of 2025.

Planning for required minimum distributions

The planning need for required minimum distributions arises from two distinct concerns. The first and most obvious concern is the penalty. If you do not take your required minimum distributions then you will lose a lot of money to the 50% penalty. Fortunately, custodian where you keep your assets may help you with this. You may not need to do all of the calculations yourself. However, you are the one ultimately responsible.

The next concern is the effect that required minimum distributions will have on your retirement income plan. If required minimum distributions are less than what you had planned on taking anyway then it really isn’t a big deal. Remember, required minimum distributions are just that… the minimum you are required to take. If your required minimum distribution is higher than your desired distribution, you’ll want to adjust your long-term plan.