Retirement income is inherently dependent on many different factors. This is true because retirement income planning involves accounting for unpredictable variables over a long time horizon, and weighing them against the comfort level of the individual retiree. Inflation is one of those factors.

Even for a given amount of retirement savings, different retirees can have very different retirement incomes given the way they choose to plan for the various factors.

While not every retirement withdrawal strategy involves inflation adjustments, many do.

The widely-cited 4% rule expressly accounts for inflation and calls for annual spending adjustments.

Adjusting withdrawals for inflation, while practical, does create a planning concern for your investment portfolio. If you are going to increase spending to keep up with inflation, you are exposed to the risk of abnormally high inflation rates.

The concern of high inflation is whether you can sustain your desired withdrawals to support your retirement income. If you can’t, you will run out of money before the end of your retirement if you don’t reduce your withdrawals.

Income vs Expense

To think about inflation’s direct effect on your retirement portfolio, think in terms of balancing your personal budget. If your income is higher than your expenses, your savings will grow. If your expenses outweigh your income, you spend down savings or go into debt.

Investment Return vs Inflation

Now think in terms of balancing income and expenses with regards to your investment portfolio instead of a budget. Income in this case is the gains you make from capital appreciation and the literal income you get from interest payments and dividends.

The portfolio expense in this analogy is your annual withdrawal.

When adjusting withdrawals for inflation, inflation is the driver determining your level of expense in regards to your investment portfolio. If inflation is persistently high, you will have to withdraw an increasingly larger amount each year.

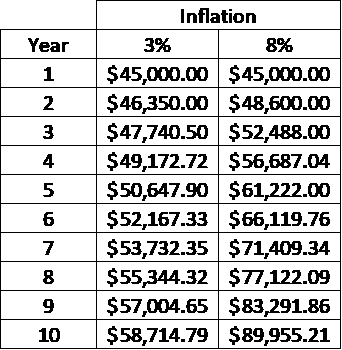

Suppose you withdraw $45,000 from your portfolio each year adjusted for inflation. Consider the effect on the value of withdrawals under 3% inflation and 8% inflation.

Notice that the amount you have to withdraw under the 8% inflation is significantly higher. This increases the potential of eroding your retirement portfolio to a point of not being able to provide retirement income.

8% inflation is a high estimate for an entire decade, but it illustrates the point quite well. Average inflation by decade has varied from slightly negative in the 1930’s to almost 10% in the 1910’s. Individual years vary more. Inflation was 13.3% in 1979 and only 1.1% in 1986.

How Long Will Your Portfolio Last?

The real question underlying the inflation issue is whether your portfolio will last long enough to provide you with income for the duration of your retirement. You can’t know with certainty, because we can’t predict what investment returns or inflation rates will be in the future. However, you can still plan for inflation. The Bengen study that produced the 4% rule provides some good insight here in terms of withdrawal rates. To estimate how long your portfolio will last, you can use historical data.

The safe maximum withdrawal rate for a given portfolio is the maximum percentage that can be withdrawn in the first year and adjusted for inflation in the following years. Bengen found that historically, 4% would give you 30 years of income.

Stocks for the Long Run

Your portfolios asset allocation plays an important role. Traditionally, the equity portion of your portfolio declines the older you get. A common rule of thumb is to subtract your age from 100 and the remainder is what you should have in stocks.

Say you are 60. 100-60 = 40. The rule would have you invest 40% of your portfolio in equities. By the time you are 70 you would only have 30% of your portfolio in equities.

Remember though, that over the long-term stocks are much more likely to provide you an adequate return to fuel higher withdrawals driven up by inflation. Most retirees will need the exposure to the market risk premium in order to generate enough from their portfolio. If you have too little equity, your portfolio may not last. For reference, Bengen based his 4% rule off of a 50/50 portfolio that was re-balanced annually, but the allocation did not change.